Vital Signs Data

Sustainable Development Goal (SDG)

SDG 1: Reduce poverty in all its forms.

Low-Income Status

Low-Income Status

In Prince Edward County, 2,470 individuals (10.1%) were classified as low-income according to the 2021 Census. The low-income measure (after tax) is defined as having an income below 50% of the median adjusted after-tax income. In 2021, this threshold was approximately $36,000 for a household.

- Those at highest risk of poverty include people living alone, individuals with lower education levels, and those with activity limitations.

- 31% of low income individuals are in the labour force.

- PEC has the highest percentage of low income seniors among Ontario census divisions (33%). (Rural Ontario Institute Seniors Fact Sheet)

Effects of Poverty

Effects of Poverty

As the Government of Canada continues to phase out emergency supports, populations made most marginal will face renewed precarity amid rising inflation, the high cost of living and long-term impacts of the pandemic—such as long COVID and increased rates of disability, mental health problems, and delays in the education and development of children and youth.

National Advisory Council on Poverty 2022

Income is perhaps the most important social determinant of health. Level of income shapes overall living conditions, affects psychological functioning and influences health-related behaviours such as quality of diet, extent of physical activity, smoking and excessive alcohol use. (Social Determinants of Health)

Common indicators to measure less poverty in communities include: income/poverty rate, ability to gain employment, access to quality education, access to affordable housing, access to affordable childcare, and access to affordable transportation.

Empowerment and capacity-building initiatives in Prince Edward County are vital to help vulnerable people achieve their full economic potential.

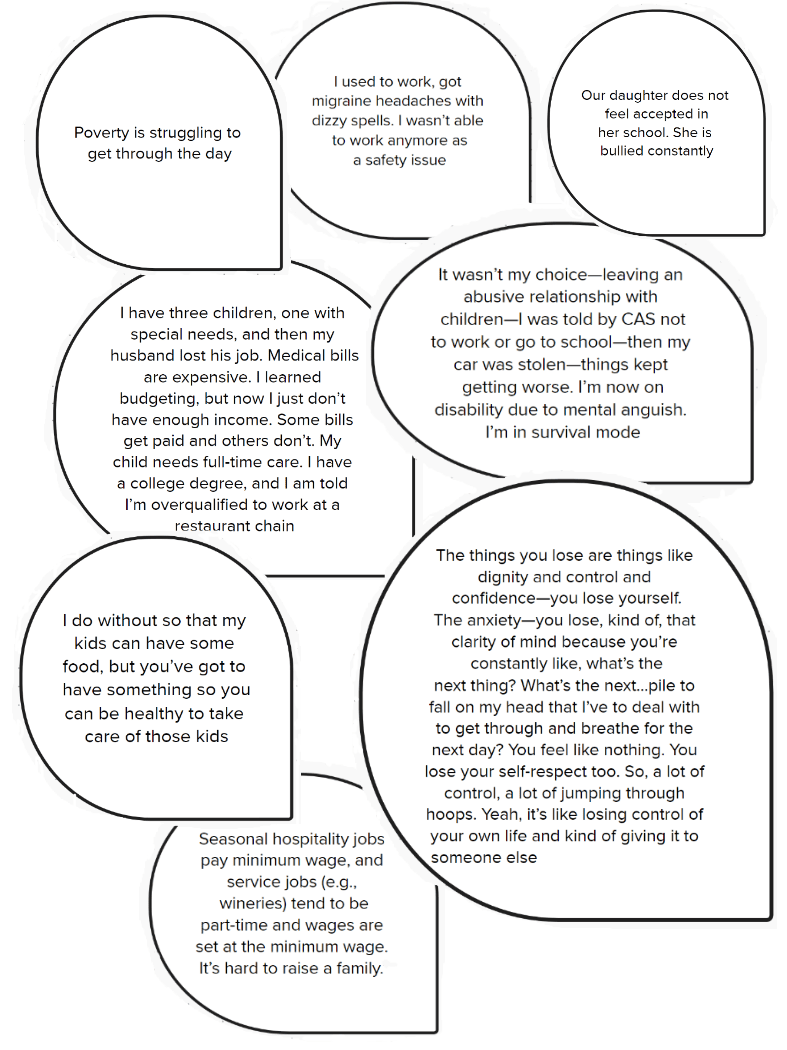

Quotes from people with lived experience

Quotes from people with lived experience

Risk Factors for Poverty

Some people are more susceptible to poverty. See the Poverty Risk Profile for PEC.

Living Alone

27% of PEC's population lives alone. Single adults are more likely to live in poverty. Working-age singles constitute the largest proportion of beneficiaries on social assistance, and they are three times as likely to live in poverty as the average Canadian. (Institute for Research on Public Policy)

People Living with Disabilities

People living with disabilities face barriers that increase their risk of living in poverty. The individual monthly $2,000 CERB payments were significantly higher than the $1,169 that people receive from the Ontario Disability Support Program and the $733 that people receive from Ontario Works — underscoring the difficulty of living on existing social assistance programs. (Health Providers Against Poverty)

Precarious and Low-paying Employment

PEC's economy heavily depends on seasonal tourism and agriculture, leading to a prevalence of part-year, part-time employment. Additionally, PEC has a high proportion of self-employment. Workers with precarious employment are less likely to access work-related benefits such as an employer sponsored private pension plan, disability insurance or a family dental plan. (Govt of Canada, Towards a Poverty Reduction Strategy)

19.6% of PEC workers are employed in food services, accommodation and retail sales (Ontario Ministry of Agriculture, Food and Rural Affairs, Lightcast 2023) – sectors with the lowest average weekly earnings and greatest employment impact from COVID-19. (Statistics Canada, Labour Force Survey January 2022)

Women in Canada are at an increased risk of living in poverty in old age. The prevalence of women who are 75 years old and over and living with low-income status was 21% compared to 13.9% of men in the same age group. (Govt of Ontario, The Gender Pension Gap).

Single Parent Households

10.6% of PEC families have a single parent (7.9% female parent, 2.8% male parent). (Prince Edward County 2021 Census Profile) In Canada, 21% of single mothers raise their children while living in poverty (7% of single fathers raise their children in poverty), where women who work full-time earn about 72 cents for every dollar earned by men. (Homeless Hub)

Marginalized Populations

Historically marginalized groups such as Indigenous, racialized people, recent immigrants and refugees, people with disabilities, single-parent families, seniors, youth, and 2SLGBTQ+ communities are more likely to live in poverty. (Canada Without Poverty)

Recent Immigrants

Recent immigrants may face language barriers, discrimination, difficulty having their educational and professional credentials recognized, a lack of Canadian work experience, and difficulty building social networks when they arrive in Canada. These barriers can lead to high levels of unemployment and poverty. (Govt of Canada, Towards a Poverty Reduction Strategy)

The Rural Experience

Actions

Recommendations from Understanding Systems: National Advisory Council on Poverty, Transforming our Systems 2022

- Develop robust systems and structures focused on early intervention and poverty prevention.

- Employment income and income support.

- Building equity through programs, supports and benefits.

- Dignity through enhanced access and improved service design and provision.

- Indigenous prosperity through truth, reconciliation and renewed relationships.

(National Advisory Council on Poverty, Transforming our Systems 2022)

PEC Poverty Roundtable

PEC Poverty Roundtable

Income Tax & Benefits Screening

Income Tax & Benefits Screening

Prince Edward Learning Centre (PELC) and Prince Edward Community Care for Seniors host FREE CRA Income Tax and benefit screening programs for low-income County residents. The tax clinics are part of the Community Volunteer Income Tax Program, funded by the Canada Revenue Agency. All volunteers are vetted by the CRA and complete Vulnerable Sector Checks with the OPP. PELC refers seniors age 60+ to PE Community Care for Seniors to ensure that they are aware of all benefits available to them, and Community Care refers those under age 60 to PELC.

When these benefits help to build a financial bridge, more people can pay rent, buy food and other goods. Investment in income tax clinics and benefits screening programs has a multiplier effect when residents are productive and spend money in this community.

Municipal Financial Relief Grant

Municipal Financial Relief Grant

Starting with a pilot program in 2022, the Municipal Financial Relief Grant provides property tax or water/wastewater credits to low-income residents. eligible applications received in 2023. Learn more about this grant.

Systems Navigation

Systems Navigation

Prince Edward Learning Centre (PELC) provides volunteers with additional training in resource navigation, which allows them to identify programs and benefits that clients may be eligible for, such as assistance with energy costs. It’s also an opportunity to offer life stabilization supports, depending on individual needs, or help with bills that are past due.

Tax filing & benefits screening

Completing and understanding forms

Life stabilization supports

Financial literacy

Housing

Assistance with past due/account bills

Accessing health and dental programs

Application assistance (OSAP, EI etc)

Youth Support Navigation Service through ROC Youth Services assists PEC youth to identify, access and navigate community services relevant to their needs and goals.

Skills Upgrading

Skills Upgrading

Prince Edward Learning Centre is dedicated to helping adult learners acquire the skills needed to achieve their personal learning and employment goals.

Support is provided to:

- Upgrade Literacy & Essential Skills

- Finish High School

- Prepare to write the GED

- Prepare for Work or a Career

- Prepare for College

- Prepare for Apprenticeship & Training

- Develop Skills for Personal Independence.

Employment

Employment

Career Edge provides a variety of FREE Employment Ontario services for youth and adults. They strive to eliminate barriers to employment by connecting employers to job seekers through a paid internship model.

Through the Career Edge Youthab program, free mental health supports are provided for youth aged 16 – 24, as well as housing services.

Legal Advocacy

Legal Advocacy

Community Advocacy and Legal Centre is a non-profit legal clinic that offers FREE legal help to people living on a low income in Prince Edward and surrounding communities.

Service areas include: Abuse & family violence, Consumer & debt, Criminal law, Employment & work, Environment, French language rights, Family, Health & disability, Housing, Human rights, Immigration & refugee, Income assistance, Indigenous rights, Schools & education, Seniors’ issues, Sexual harassment at work, Victims of crime, Wills & Powers of Attorney.